Mergers and acquisitions (M&A) are increasingly common in the healthcare industry as organizations aim to consolidate resources, expand services, and enhance competitiveness. These transactions enable health systems to invest in technology and quality improvements across a broader enterprise. However, successful integration is crucial, as cultural and market differences can impact value realization.

Mergers and Acquisitions (M&A).

Core Deliverables

1. Opportunity Scouting

Identification of acquisition targets or partnership opportunities aligned with strategic goals.

2. Commercial & Strategic Due Diligence

In-depth assessment of market positioning, pipeline potential, and risks.

3. Valuation & Deal Structuring

Financial and strategic frameworks to determine fair value and deal terms.

4. Regulatory & Compliance Assessments

Analysis of legal, ethical, and compliance implications.

5. Integration Planning & Execution

Detailed roadmaps for aligning operations, culture, and systems.

6. Post-Merger Performance Tracking

KPIs and dashboards to measure realized value and integration success.

We synchronize visions.

Mergers and acquisitions (M&A) in the pharmaceutical and healthcare sectors have become increasingly prevalent as companies seek to enhance their competitive edge, expand their portfolios, and drive innovation. Many executives are poised to pursue acquisitions aggressively, particularly in the face of rising costs and the need for operational efficiencies. Recent trends indicate a significant uptick in M&A activity, especially in areas such as precision medicine and niche medical technologies. With a focus on maximizing value and ensuring seamless transitions, Motitus begins by thoroughly understanding the client’s business objectives and desired outcomes.

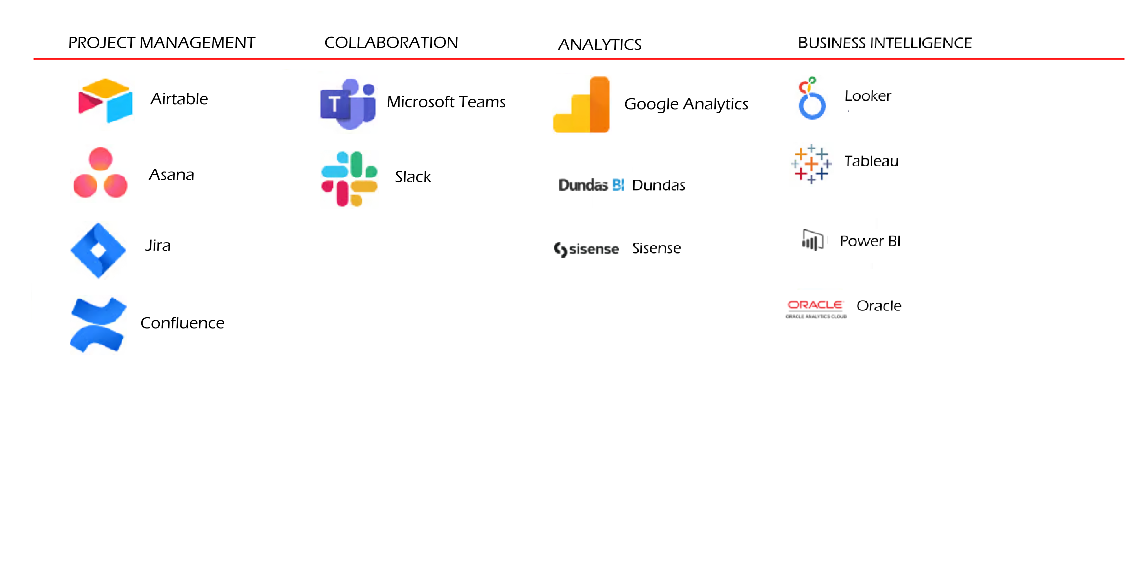

Technology We Use.